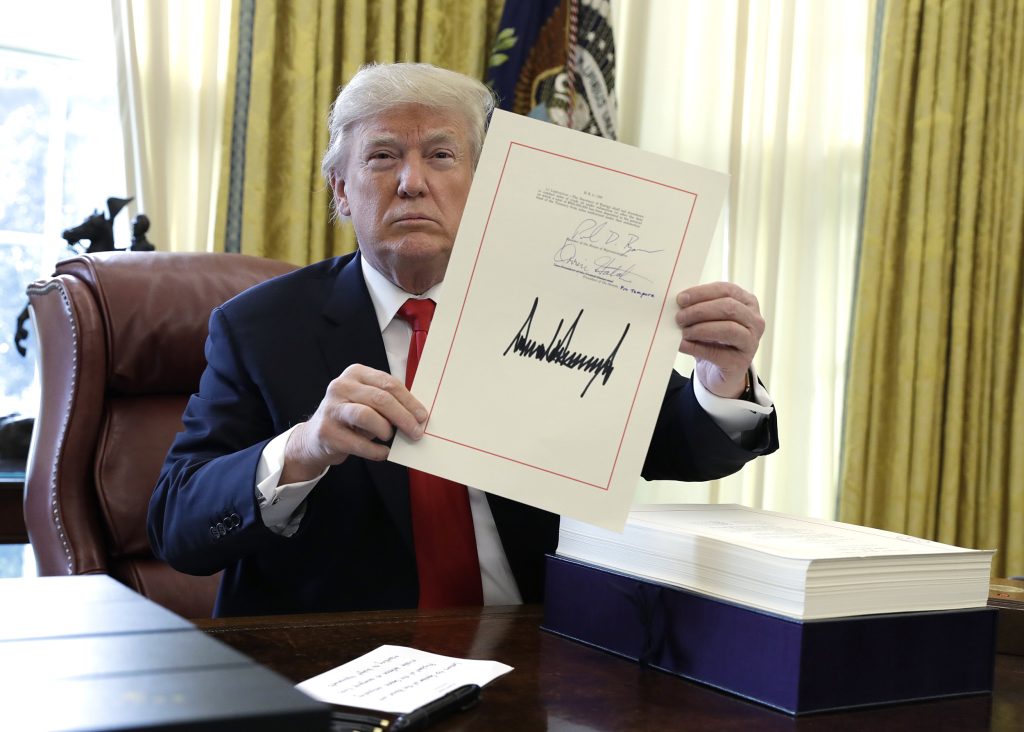

Do you remember the big tax cuts that former President Donald Trump implemented in 2017? Well, those provisions are set to expire at the end of 2025 unless Congress does something about it. This looming deadline is bad news for anyone who pays taxes because their tax bills will go up, regardless of income level.

Small businesses – which account for a large portion of America’s economic growth – will also suffer as they’ll have less capital to invest back into their business and employees. In short, no investment, no growth, no jobs without congressional intervention.

What exactly are these non-permanent provisions? The top rate decreased from 39.6% to 37%, the 33% bracket fell to 32%, the 28% bracket to 24%, the 25% bracket to 22%, and the 15% bracket to 12%.

Further, individuals seeking or attempting to preserve their wealth got a boost with two important provisions: bonus depreciation tax deduction and Opportunity Zones tax credit.

The former enabled any qualified business with 100% bonus depreciation but this has since phased out by 80%, 60%, 40%. For Opportunity Zones – areas designed for development in disadvantaged communities – investments are diminishing year after year too.

Additionally, another key provision was roughly doubling the amount of standard deductions from $13000 to $24000 for married filers thus making itemizing less popular among lower-income taxpayers (only 1 % itemize) while providing an extraordinary benefit that will vanish without congressional action come 2025.

Lastly, changes were made in terms of capital gains taxation and lifetime gift/estate taxes exemption was increased from $5.5 million all way up to $11 million dollars!

It’s easy to see why so many Americans – especially those on the lower end of the income spectrum – depend on these measures yet the current administration’s policies remain hostile towards small businesses even though our economy is struggling due to inflation and deficit spending plus alienation oil-producing nations causing global abandonment US dollar (just last week UAE & India agreed trading rupees).

All these factors should be a wake-up call to Congress if they want to avoid catastrophic consequences like decreased economic growth or worse yet pushing many families & businesses over the edge as well as creating a void job market resulting in stagnant America’s unable compete globally markets due lack resources needed propel forward.

Fortunately, there’s still a chance lawmakers can find common ground to bridge the partisan divide make TCJA permanent ensure American citizens won’t have to pay a hefty price come 2025 but instead continue prospering under lowered taxes and increase investment opportunities allowing small businesses to invest back capital employ more people promote greater economic growth.

4 Comments

Dems want all wage earners to pay more in taxes so they have more money to give to those who can’t or just do not want to work or go to school or do anything but get cash from DC for votes

Don’t forget more Money to hand out to the illegals who the Communist Democrats are allowing to invade America.

Don’t forget to foreign counties so the FJB family And ‘Big Guy’ get their 10% share

Trump can perserve these cuts when he gets back into office.

MAGA 2024

F J B and Democrats Everywhere Forever.